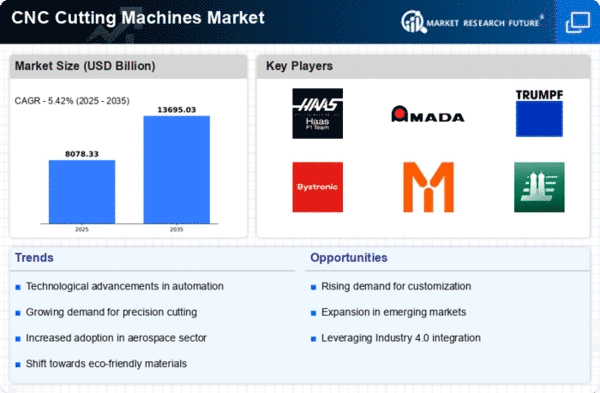

The CNC Cutting Machines Market is currently characterized by a dynamic competitive landscape, driven by technological advancements and increasing demand for precision manufacturing across various industries. Key players such as Haas Automation (US), Amada (JP), and Trumpf (DE) are at the forefront, each adopting distinct strategies to enhance their market positioning. For instance, Haas Automation (US) emphasizes innovation in its product offerings, focusing on high-performance CNC machines that cater to diverse applications. Meanwhile, Amada (JP) has been actively pursuing regional expansion, particularly in emerging markets, to capitalize on the growing demand for cutting-edge manufacturing solutions. Trumpf (DE) appears to be concentrating on digital transformation, integrating smart technologies into its machines to improve operational efficiency and customer experience. Collectively, these strategies contribute to a competitive environment that is increasingly focused on technological differentiation and customer-centric solutions.In terms of business tactics, companies are localizing manufacturing to reduce lead times and optimize supply chains, which is particularly crucial in a market that is moderately fragmented. This approach not only enhances responsiveness to customer needs but also mitigates risks associated with global supply chain disruptions. The competitive structure of the market indicates that while a few players dominate, there remains ample opportunity for smaller firms to carve out niches through specialized offerings and innovative technologies.

In November Bystronic (CH) announced the launch of its latest laser cutting system, which integrates advanced AI capabilities to enhance cutting precision and reduce operational costs. This strategic move underscores Bystronic's commitment to innovation and positions the company to meet the evolving demands of the manufacturing sector. The introduction of AI-driven solutions is likely to attract a broader customer base seeking efficiency and cost-effectiveness in their operations.

In October Mazak (JP) unveiled a new line of hybrid CNC machines that combine additive and subtractive manufacturing processes. This development is significant as it reflects a growing trend towards versatility in manufacturing technologies, allowing customers to streamline their production processes. By offering hybrid solutions, Mazak is not only enhancing its product portfolio but also addressing the increasing demand for flexible manufacturing systems that can adapt to various production needs.

In September FANUC (JP) expanded its partnership with a leading robotics firm to integrate robotic automation into its CNC cutting machines. This collaboration is indicative of the broader trend towards automation in manufacturing, which aims to improve productivity and reduce labor costs. By leveraging robotics, FANUC is positioning itself as a leader in the integration of cutting-edge technologies, which could provide a competitive edge in a rapidly evolving market.

As of December the CNC Cutting Machines Market is witnessing trends such as digitalization, sustainability, and AI integration, which are reshaping competitive dynamics. Strategic alliances are becoming increasingly important, as companies seek to leverage complementary strengths to enhance their offerings. The competitive differentiation is likely to evolve from traditional price-based competition to a focus on innovation, technology, and supply chain reliability. This shift suggests that companies that prioritize technological advancements and sustainable practices will be better positioned to thrive in the future.